This post is part of a new series in which I will show how to figure out if we can build a strategy using some assets’ correlation. Let me introduce the assets:

S&P500

Mini S&P500 future (continuous contract), daily, Source: TradingView

The Standard & Poor's 500 is one of the main American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. As you can see, this index hasn´t stopped raising since 2011.

Gold

Comex Gold future (continuous contract), daily, Source: TradingView

The Comex Gold is one of the most important futures. You can trade it directly or you can use it to hedge your stock portfolio. Historically this hedge has been successful and has protected the portfolios versus big drawdowns. It´s recommended to have at least a small part of your investments in gold (even if it´s in an exchange-traded fund that tracks this metal)

I reviewed Gold futures and ETF´s last year: Gold Analysis

Spread between SP500 and Gold futures, daily, Source: TradingView

To simplify the calculation, I decided to make the spread as 1 E-mini S&P500 future minus 1 Comex Gold future. As you can see, the relationship was negative before 2013 because the gold price was higher than the S&P. Since then, this spread has raised almost like the US index. This explains that the different QE programs calmed down the uncertainty (so the investors started buying the S&P and started selling or reducing their gold portfolio)

Introduction to the study

Correlation series

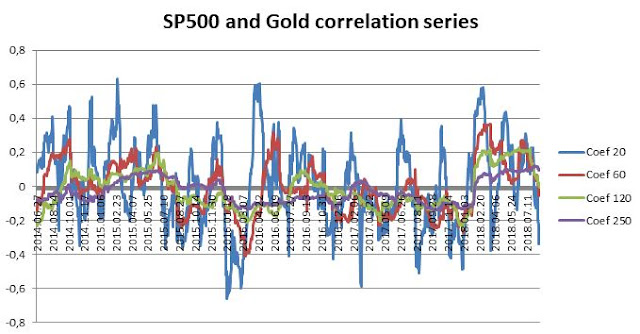

For this part, I chose 4 correlation series (20, 60, 120 and 250 days) that represent different time frames.

Correlation time frames table, own elaboration

The main reason for choosing this time frames is to make comparisons and to see if I can work out a strategy in the following posts.

S&P500 and Gold correlation series, own elaboration

We can’t get any conclusion from this chart apart that the long-term correlation between S&P500 and gold is negative (the most part of the time). One of the things I would like to study in the following days is if I can build a profitable system based on the correlation series divergences. For now, I can show the different charts with the asset prices and the correlation (The Y left axis represents the price of the assets and the Y right axis represents the correlation coefficient):

S&P500, Gold, and 20 days correlation serie, own elaboration

This chart doesn’t show any clear relationship. Another problem is that is a short-term correlation that generates a lot of noise in the signals and it´s difficult to know if it´s worth to check this correlation to trade the spread.

S&P500, Gold, and 60 days correlation serie, own elaboration

The 60-day correlation is smoother than the previous one. I think that we can take advantage of the correlation every time that is above 0, however, a statistical study is required.

S&P500, Gold, and 120 and 250 days correlation series, own elaboration

As I said before, we can see that the most part of the time these correlations are below 0. Like in the previous chart we can take advantage of the correlation above 0. In addition, I would be interesting to study a trading system based on the 120 days correlations that trigger a trade every time is under -0.2. In terms of correlation’s divergence, we need to backtest it properly.

Sum up

I’ve chosen these assets because they are really important. The S&P500 reflects the US economy and the Comex Gold can be used as an investment or as a hedge vs the main index in a recession. Sadly this post is an introduction. I will analyze the systems proposed using advanced statistics and some backtests. As a reminder, the systems will be based on the correlation and its divergences.

#trading #investing #correlation #ES #GC #SP500 #Gold #statistics

No comments:

Post a Comment

Thank you for participating in fxandfixedincometradring.blogspot.com