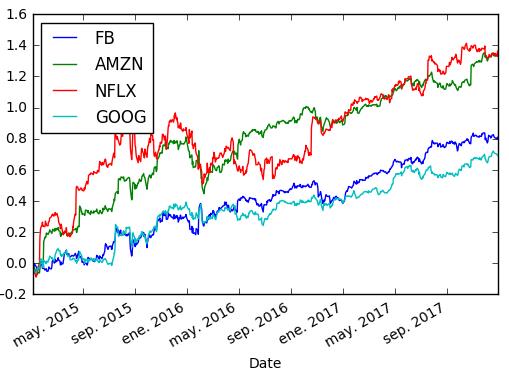

Everyone knows about the FANG stocks rally. But what does FANG mean? It’s a group of technology stocks, Facebook, Amazon, Netflix, and Google. If we look back to the beginning of 2015, we would regret not having invested in these stocks. Please bear in mind that it’s my first article using Python, so it can seem a little bit simple.

Stocks summary

Facebook stock, own elaboration with python and Quandl

Facebook is the biggest social network. It enables users to share opinions, ideas, photos, videos, and other activities online. It´s involved in the development of social media applications for people to connect through electronic devices. Its products include Facebook, Instagram, Messenger, WhatsApp, and Oculus. The revenue comes mainly from advertising.

Amazon

Amazon stock, own elaboration with python and Quandl

It´s engaged in the provision of online retail shopping services The efficiency of its distribution centers makes difficult to compete with Amazon. In addition, they have Amazon Web that it’s focused on the global sales of computing, storage, database, and AWS service offerings for start-ups, enterprises, government agencies, and academic institutions.

Netflix

Netflix stock, own elaboration with python and Quandl

This company provides subscription service streaming movies and TV episodes over the Internet and sending DVDs by mail. Netflix obtains content from various studios and other content providers through fixed-fee licenses, revenue sharing agreements and direct purchases.

Google stock, own elaboration with python and Quandl

Alphabet operates as a holding company with interests in software, health care, transportation and other technologies. It operates through 2 segments: Google and Other Bets segments. The first one includes the following services: Search, Ads, Commerce, Maps, YouTube, Apps, Cloud, Android, Chrome, Google Play as well as hardware products, such as Chromecast, Chromebooks, and Nexus. The other one includes: as Access or Google Fiber, Calico, Nest, Verily, GV, Google Capital, X, and other initiatives.

Individual Stocks

At this point, I believe that you have your own preferences but let´s imagine that we are in 2015. Wouldn’t be better to create a portfolio with all of them? Also, it´s another way to diversify our portfolio

Log returns own elaboration using python

We can see how the individual stocks performed in the period. As you can see Netflix has been the more volatile.

Arithmetic Returns of the individual stocks

Google was the worst performer but it doubled in value. I would like to remind you that the Nasdaq index has returned 63% since 2015.

Before we put together all these stocks, let´s check the individual distributions:

Log return distributions own elaboration

All of them have in common that the extreme observations are positive, which explains in part the reason of the rise in these stocks.

The Portfolio

After reviewing these companies and considering that they have different business units, we decide to create a portfolio. In order to make it simple, we can assign the same weight for each stock, in this case 25% of the initial capital.

Portfolio statistics and log returns distribution own elaboration

Considering the long run and this portfolio´ strategy (buy and hold), it´s easy to think that the majority of the daily returns are bigger than zero. This is confirmed by the chart above.

Is it safe to build a portfolio like we have done? No, some of the reasons are that it´s not properly diversified and the correlation between the assets is positive. Luckily the companies have diversified some of their activities and they are heavily investing in technology which will bring revenue in the future.

The portfolio return has been 104%.

Portfolio return own elaboration

The portfolio return has been 104%.

Portfolio return own elaboration

Portfolio drawdown history, own elaboration

One of my favourites risk metrics is the drawdown. I created this chart showing the portfolio drawdown over the time. The maximum drawdown was 14.10%. This figure surprised me but the main concern is that the stock market raised on a daily basis

Sum up

I hope you like it. We have seen how the main tech portfolio has behaved since 2015. I wouldn’t invest in this kind of portfolio for the reasons mentioned above. In addition, I think that the index rally has been supported by an accommodative monetary policy. Using Python and Quandl has been great and I hope to bring more content in the future. Thanks.

Have a good trading!!

Disclaimer

I wrote this article myself, and it expresses my own opinions that shouldn't be used as a trading advice. Trading carries considerable risk due to the high leverage involved

#Alphabet #Amazon #drawdown #Facebook #FANG #Google #investing #maxdrawdown #Netflix #portfolio #python #quandl #stocks #Trading