Today I will show the trading system behaviour from October 2008. Let me introduce the macro situation before I review the backtesting results.

Brief description

The financial crisis started later in 2007. The stock market suffered a big correction in 2008. The volatility was far higher than nowadays. The central banks implemented the quantitative easing programs in order to stabilize the economies around the world. This is an example of the German Dax index and the Eurostoxx index.

Source: TradingView, DAX vs Eurostoxx futures, daily, from 2008 to 2018

Results from October 2008

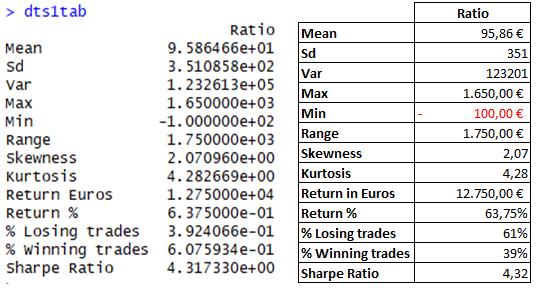

10 Yrs Backtesting results, own elaboration with Excel and RStudio

The main difference is the volatility in the underlying. As you can imagine later in 2008 the volatility was really high and the stock market was in free falling until it bottomed in 2009.

As you can see the big bounces in 2008 are the reason for the big range shown in the backtest.

Comparison with the 5 Yrs Backtesting

Comparison between the 5Yrs and 10Yrs backtesting, own elaboration

You can see a big improvement in the 10 Yr study vs the 5 Yr. The average profit was 151.28 EUR vs 95.86 EUR. The standard deviation and variance were higher due to the volatility from 2008 and 2013. The range is bigger as well because the stock was trading higher. Considering the strict risk management, I´m surprised about the winning trades percentage. I believe that a mean reversion strategy was the best one at this time, even more with the actions taken by the central banks. In addition, the return’s distribution changed and it shows higher extreme figures (in the positive side, which means a high probability of bigger profits) The system traded 733 times vs 130 times in the last 5 years, the profits are concentrated in the first 300 trades. The Sharpe Ratio is slightly worse.

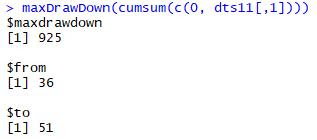

Max Drawdown, own elaboration using RStudio

I´m happy with this figure, losing 2820 EUR was the equivalent to 3.16% of the portfolio. This is a very conservative figure which I consider ideal. Sadly this is not applicable to another kind of strategies because the system opens and closes the positions on the same day.

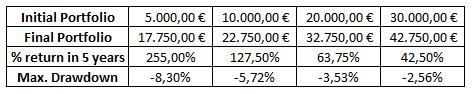

Portfolio growth, own elaboration using RStudio

There is not much to say about this chart. You can see the change in volatility from the first years to the recent years. The biggest profits are concentrated in the first 300 trades. The initial portfolio was 20000 euros. I haven´t included the commissions.

Sum up

We have seen how this system behaved during the last 10 years. You can think that is overfitted and this post doesn´t have value because I tested the system in the right period. This is not the purpose of this little article. I´m surprised with the performance but if you had bought the Dax in 2009, you would have multiplied your portfolio’s value by almost 4. In the next post, I will compare the trading system vs the DAX. I hope you like it. Thanks for reading.

Have a good trading!!

Disclaimer

I wrote this article myself, and it expresses my own opinions that shouldn't be used as a trading advice. Trading carries considerable risk due to the high leverage involved