Mario Draghi didn’t surprise the market with his speech. He acknowledged a moderation in the pace of the eurozone recovery but he said that it´s early to change the monetary policy. Some analysts believe that the ECB will wait until July to provide forward guidance. I don´t want to speculate but maybe the dovish message was due to the strength of the euro. I would like to remind you that the ECB is buying assets for the value of €30bn a month. The question here is what is going to happen with these markets as soon as the central banks stop these quantitative easing programs.

Euribor Spreads

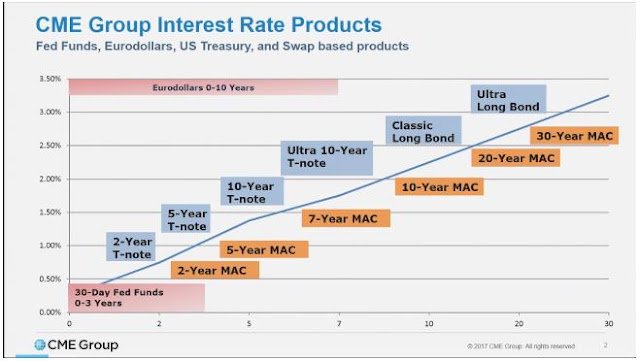

I will use the Euribor contracts listed in Eurex because I don´t have access to the ones listed on ICE. Sadly these contracts aren´t traded as much as the ones on ICE but they show similar prices.

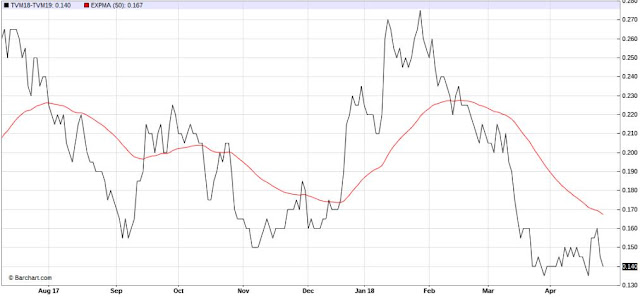

Euribor Jun18-Jun19 spread, source: Barchart

The difference between these contracts is narrowing what indicates a flattening of the Euribor curve. It seems that the current level can act as a support.

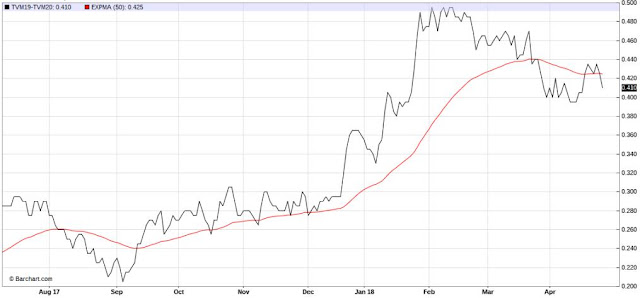

Euribor Jun19-Jun20 spread, source: Barchart

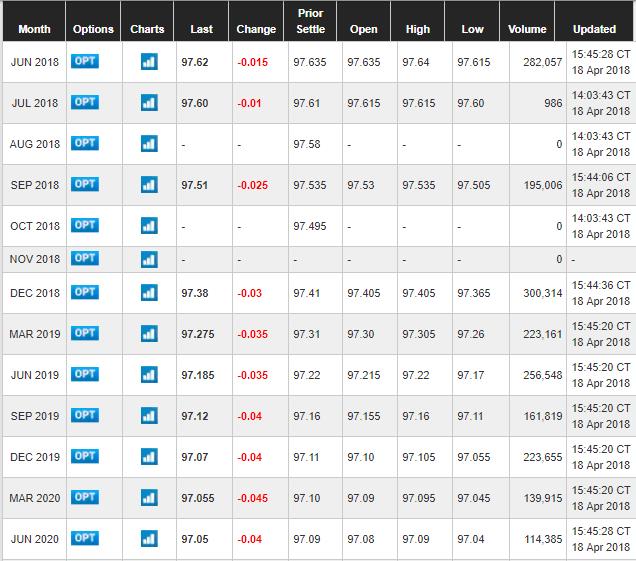

As you can see the curve steepened from September 2017 to March 2018. At the moment is near the support at 0.400. The Jun20-Jun21 spread has the same shape and this is very interesting for me. In the case of the Eurodollar, you can see how the spreads show that the curve is steepening for one period in flattening after 2020. The truth is that the ECB hasn´t changed the policy in the last 8 years and the inflation is still low. Can we see any movement in the outrights?

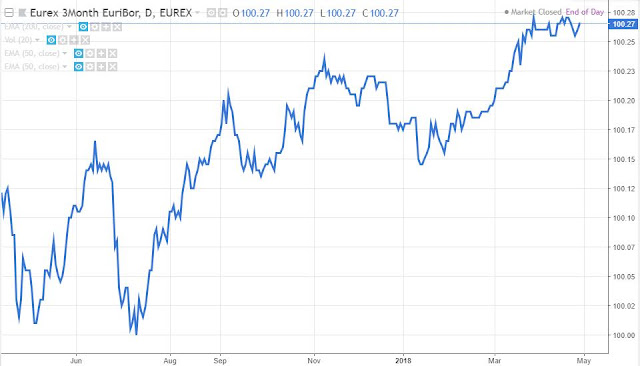

Euribor Jun18 futures, source: TradingView

This contract changed the trend one year ago. In my opinion, the European economy looks pretty much the same as 2017.

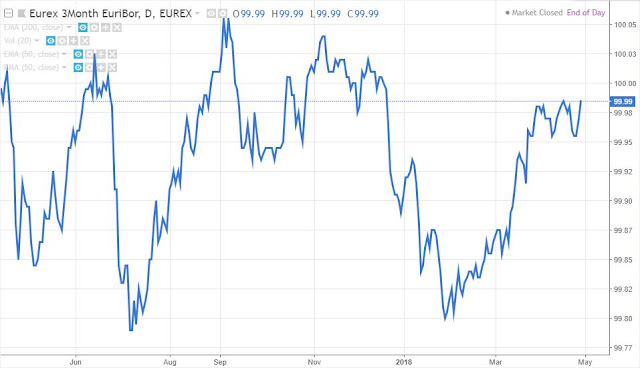

Euribor Mar19 futures, source: TradingView

This contract is more volatile but it shows exactly the same movement as the previous one.

Euribor Dec19 futures, source: TradingView

The last 3 charts show how the different futures went up in 2018. What are they discounting? Is the current European economy worse than in 2017? Will we have a global recession in 2020?

One of the best trades

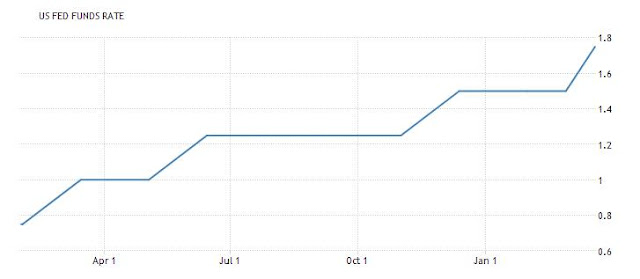

We have briefly seen how the Euribor futures behaved during the last year. As I said the European Central Bank hasn´t changed the economic policy while the Fed has been raising rates for a while. Considering this, the idea was clear: long Euribor futures and short Eurodollar futures.

Euribor Dec18 – Eurodollar Dec18 Spread, source: TradingView

This trade has been amazing (and I think that it can continue at least for a couple of months) and probably we will read about it in the next “Hedge Fund Market Wizards”.

Sum up

The ECB delivered the words that we expected. Draghi has a difficult job and the protectionism threaten doesn’t help. The Euribor futures are not moving at all, their movements are tied with the European Central Bank forward guidance and the data. The Euribor-Eurodollar spread has been one of the best trades from 2017. It has captured the different economic policy in two economic areas.

Disclaimer

I wrote this article myself, and it expresses my own opinions that shouldn't be used as a trading advice. Trading carries considerable risk due to the high leverage involved