Introduction

The other day, I had a really interesting conversation with one of my friends. It was the kind of thought that we can have on Sundays. We were wondering how to get one million dollars (or Euros, British Pounds, it's applicable to all currencies)

Discussion

In the beginning, we were saying silly things that come from social media and it's difficult to verify if it's true or not. After that, we briefly talked about real estate. Everything looked great but the high capital required to invest in this kind of asset makes it difficult (without having already saved part of

We follow the main hedge funds, so we started talking about trading legends such as Jim Simons, George Soros, Warren Buffet, Ray Dalio, Steve Cohen, William Ackman and Ken Griffin (The list is really big, they are only a few of the best)

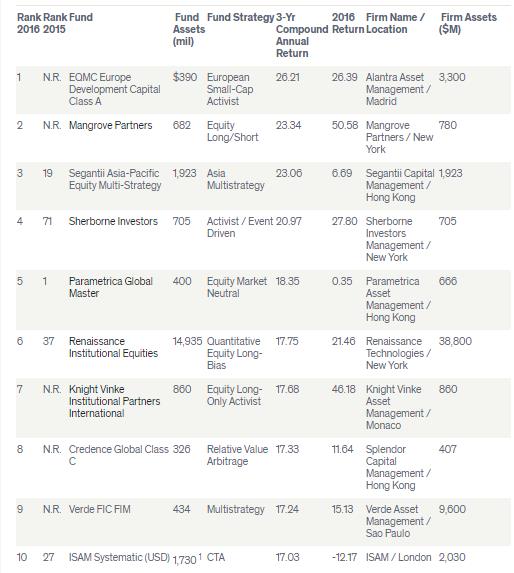

The next table shows the 3-year compound return for some hedge funds:

Penta Top 100 Hedge Funds, Source: Barrons

You can find the whole list on the link below:

This idea was great but considering that some of the strategies used by hedge funds (and asset management, CTAs… ) require big sums of money, it was discarded automatically. In addition, we don´t know wealthy investors and we don’t have any track record. Another solution is to invest directly in one of these entities, but again, the mínimum investment is pretty high.

At this point, we were aware of the reality but I said that we can get it! The only requirement is commitment and patience (this will be discussed later on)

The model

Before I explain this model I would like to make some assumptions:

- I consider that the money saved every month is the same for the whole life of the individual.

- All the savings are for investment purposes.

- The individual can’t withdraw any money once it´s invested.

- The return is positive for the whole life of the investment (the return is considered as an annual average return of the investment)

- The investment is not defined

So basically there is no secret, the idea is based on saving money every month and invest it in the asset that you consider suitable for you.

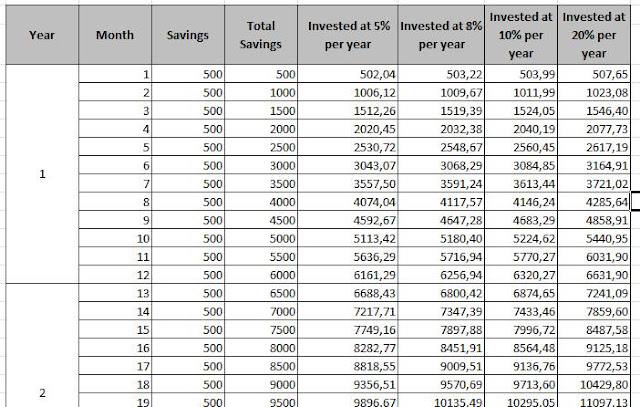

The table used for the calculation, own elaboration

As you can see the table has different columns, let me explain them. The year and the month are in order for charting purposes. The savings is the amount saved per month (in the example is 500 but I´ve done it for 300, 700 and 1000 units of currency every month) The rest of the columns represent a financial calculation to reflect the effect of investment (in that case, I’ve chosen monthly compounding (Amount saved * (1 + Annual return % ) ^ (1/12))

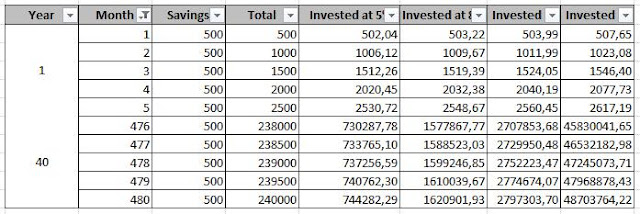

Example of the first 5 months and the last 5 months, own elaboration

This is the same table as the previous one. I want to show the top and the bottom of the table used for the charts that I’m going to explain now.

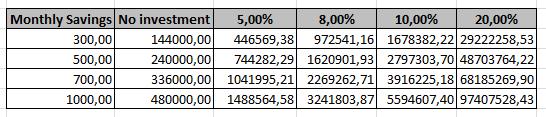

Total savings after 40 years without investing them, own elaboration

These are the amount we would have after 40 years (or 480 months) without investing. Obviously, if you save more, you will be wealthier in the future.

Final amount after investing for 40 years, own elaboration

This table is really interesting because shows the capital after investing for 40 years. Here we can see why investing is very important to build wealth. Let's say that we can afford to save 300 units of currency per month. After 40 years, we check the account and we can find 2 outcomes depending on if we decided to invest or not. Without investing the savings, we would have 144000 while if we had invested at 5% per year, we would have made 446569,38. Investing generates 3 times more money than only saving (there is risk in every investment and you should check if it’s suitable with you or not) Returning 10% or more per year is not impossible but doing consistently is very difficult. However, if you get it, you will see your investments grow quickly.

Charts about the lifetime investment for the different average returns and savings levels, own elaboration

Here we can see the effect of compound interest over time. As Albert Einstein said once: “the power of compound interest the most powerful force in the universe”

Now coming back to the title of this post, let’s find out how many months of savings we need to reach 1 million:

Months needed to reach 1000000, own elaboration

Sadly for the lower saving quantities is not possible to reach this figure or a high return is needed. Sadly there is a high risk involved in strategies that return high return. For the rest is easier but it’s not an overnight process. At this point, we need patience and keep working hard.

Why only a few percentage of people become as wealthy as in the example?

- Investing is not as linear as I showed. There are years in which you make a profit and years in which you may lose money or even you can be breakeven.

- Saving money sometimes depends on a personal situation (There are so many things in life more important than saving a fixed amount every month)

- At the beginning of your professional career the salary is low and after that, it should adjust according to the experience.

- After saving “X” amount of money, you can think of relocating to a better property, getting a car or something that won't allow you save as you have been doing until now (maybe your salary has increased enough to cover this expenditure via personal loan but it’s difficult and it doesn’t apply to everyone)

- The example shown doesn’t apply to everyone because you need to work for the next 40 years.

Conclusion

Even if getting a million is difficult, it’s not impossible. If your personal situation allows you to save and invest every month, the only secret is Commitment and Patience. You need to understand the investments and the risk involved.

All the best!!